In the realm of taxation, IRS Form SS-4 stands as a critical document. Marking its significance like an earthquake to a seismograph, this form is used to apply for an Employer Identification Number (EIN). It acts as a social security number for business entities, and as we step into the new year, the IRS Form SS-4 instructions for 2023 have been updated to guide taxpayers correctly.

SS-4 Tax Form Instructions for 2023

Here, ss4irsform.net emerges as a beacon of assistance. Consider our website as a trusted tax advisor that never sleeps. Armed with a printable IRS Form SS4, a comprehensive collection of expertly curated materials, it propels individuals and businesses toward accurate template completion. The site's value is immeasurable due to its exemplary usage of instructions and examples, ensuring no IRS SS4 EIN form is filled with confusion or inaccuracies. Thus, ss4irsform.net puts simplicity and clarity at the forefront, making tax processes less of an uphill climb for every taxpayer.

Master IRS Tax Form SS-4 for Better Business

Having an EIN is mandatory under certain conditions. Primarily, business entities are required to fill up the IRS SS4 application form when they're just setting up. Sole proprietors, corporations, partnerships, estates, trusts, and non-profit organizations fall into this category. Additionally, those who are responsible for certain trusts, like a living trust, need to complete the SS4 form.

However, exceptions always exist in the rigid world of taxes. In certain circumstances, filling and filing an SS4 IRS Form is not obligatory.

- For instance, single-member Limited Liability Companies (LLCs) disregarded as separate entities from their owners are exempt.

- In addition, simple trustees, receivers in bankruptcy, personal service corporations, and inactive corporations are excused from this duty.

- It's interesting to note that even a trust for Single-Member LLC, when the owner is also the trustee, finds its way into this list.

Now, when do you not need to file IRS Form SS4? In business scenarios, filers of Forms 8832, 2553, or 1024 who have already provided the information required on Form SS4 are exempted from filing it separately. This simple rule helps to avoid paperwork redundancy and streamlines your taxation processes.

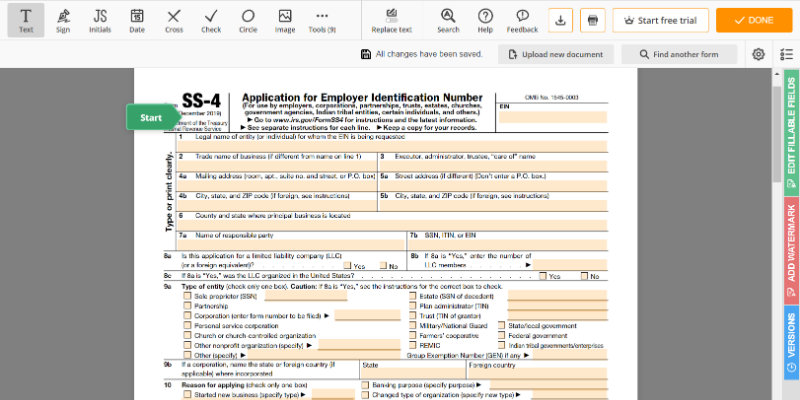

Blank SS-4 Form: Structure & Requested Information

Filing your taxes can be a challenging task, particularly if you aren't accustomed to financial paperwork. Forms like the IRS SS-4 are vital but difficult to decode without systematic guidance. Below is a simple, step-by-step guide to assist you in this process.

- Start by visiting our website, where you can obtain an online SS4 application. Check every field and note down the demands before you initiate filling. You can fill in relevant fields directly in the digital form, making the bureaucratic process swift and simple. Or download the PDF to work with the application offline.

- Don't start filling in until you've rounded up the necessary documentation. While the process is simplifying, having this on hand flattens potential hurdles. Below is the required information:

- Legal Name of entity - as fundamental as the 'given name' for a person, this is the official legal name your business goes by.

- Trade Name of the business - this might be different from the legal name, and it's akin to a 'nickname.' It is the name your business is known for in the commercial world.

- Executor, administrator, trustee, “care of” Name - this person, comparable to a legal guardian, acts on behalf of the entity in all related government filings.

- Mailing address - this is the correspondence point, say a 'mailbox,' where you'd receive all official communications.

- Name of the responsible party - just like a 'class monitor', this individual has control over or entitlement to, the funds or assets in the entity.

- SSN, ITIN, or EIN of the responsible party - these are identification numbers for the responsible party.

- Type of entity - this refers to your business structure, whether a sole proprietorship, partnership, corporation, etc. Almost like designating if a place is a 'house' or an 'apartment building.'

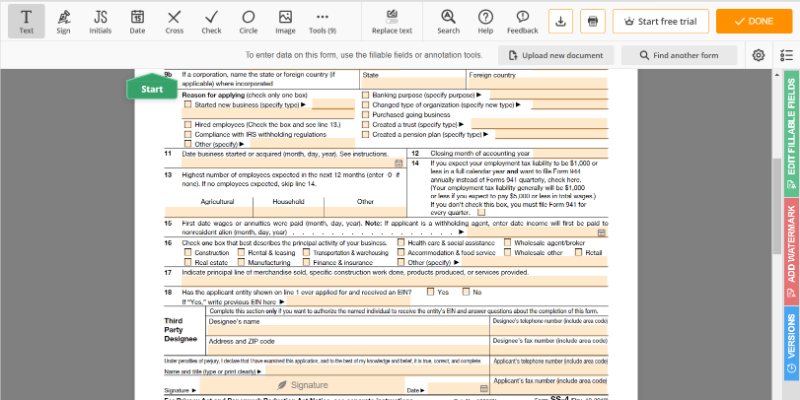

- Reason for applying - you need to explain why you're getting the EIN. It's like stating the purpose of getting a driver's license.

- Carefully fill out each part of the SS4 blank form, checking each box and confirming your information. Remember, corrections are easier in this stage than post-submission.

- Save or print IRS tax form SS4 to file with the Internal Revenue Service. It can be done electronically or via mail. It’s wise to review your work or let a tax confidant inspect it.

IRS SS-4 Application Form Submission

The SS-4 tax form is integral for businesses, with no set due date for submission. Instead, you should file IRS Form SS-4 online immediately after your business's inception. This timeline is established to promptly assign an Employer Identification Number (EIN) to your entity, facilitating tax filings and business operations. Unlike most tax forms, there's no structured mechanism to apply for an extension for your SS-4. Simultaneously, remember that having an SS4 form copy for your records is essential to effective business management. Overall, ensure you complete the SS-4 in a timely manner to ensure the smooth running of your business's tax-related duties.

IRS Form SS-4: Apllication for an EIN

IRS Form SS-4: Apllication for an EIN

SS4 Printable Form

SS4 Printable Form

Online SS4 Form

Online SS4 Form

Printable SS-4 Form

Printable SS-4 Form

Online SS4 Application

Online SS4 Application